- Brokers

- Employers

- Employees

- Solutions

- Benefits Administration

- Claims Administration

- Comprehensive Reporting

- Cost Management

- Customer Service

- Eligibility and Enrollment

- Financial Management

- Flexible Spending Accounts (FSAs)

- Health Care Networks

- Healthy Families Medical Center

- Cedar Health and Wellness Centers

- Health Management / Wellness programs

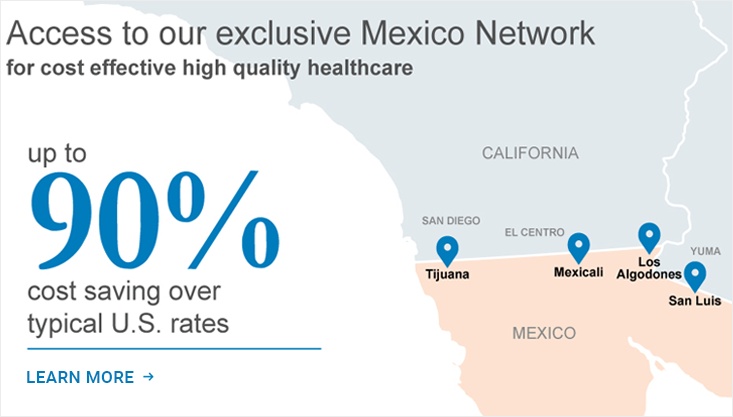

- Mexico Cross Border Program

- Pharmacy Benefits Management

- Stop-Loss / Reinsurance Solutions

- Technology and Efficiency

- Providers

- About

- News

- Contact

Login

Login